nh tax return calculator

If you make 25000 a year living in the region of New Hampshire USA you will be taxed 2425. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Enter the Price of the Real Estate. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

New Hampshire NH State Income Taxes. 5 Only on income from interest dividends Sales tax. The state only taxes interest and dividends at 5 on residents and fiduciaries whose gross interest and dividends income from all sources exceeds 2400 annually 4800 for joint.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. There are a variety of other ways you can lower your tax liability such as. This calculator is based upon the State of New Hampshires Department of Revenue Administrations Real Estate Transfer Tax FAQs.

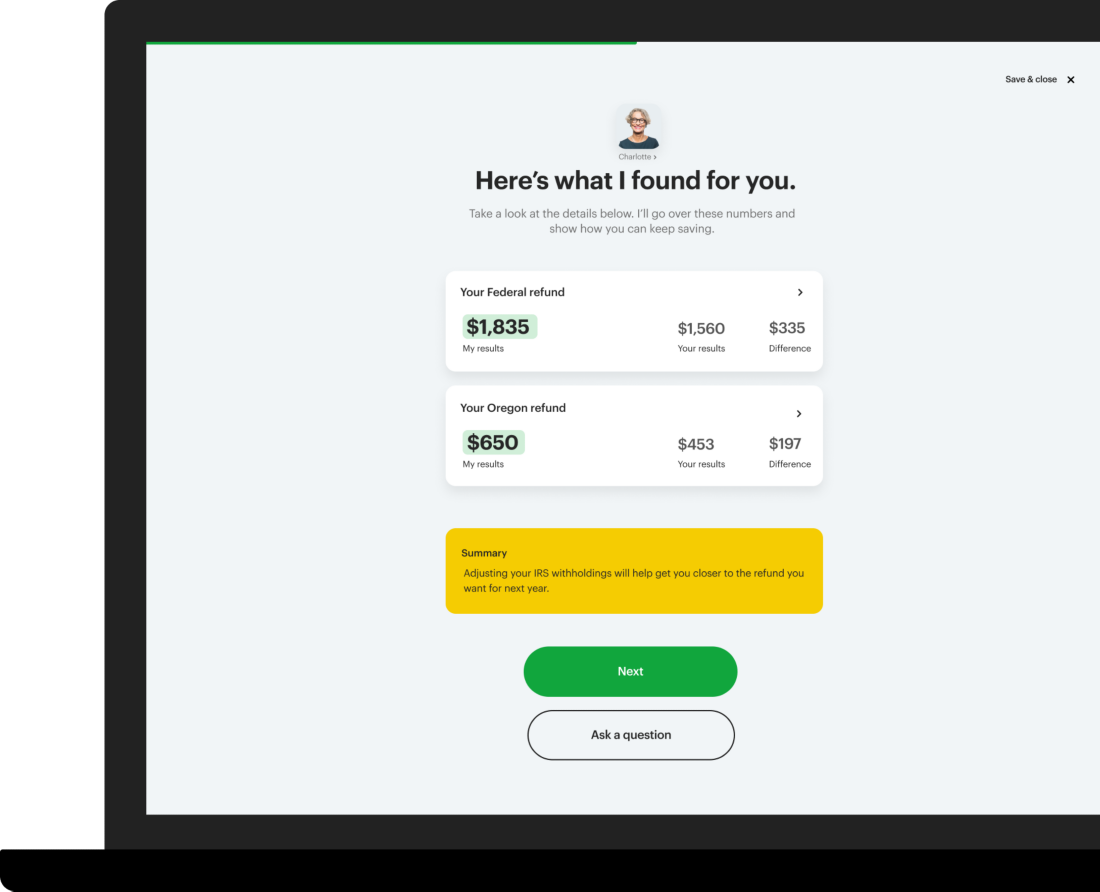

How It Works. Taking advantage of deductions. See how your refund take-home pay or tax due are affected by withholding amount.

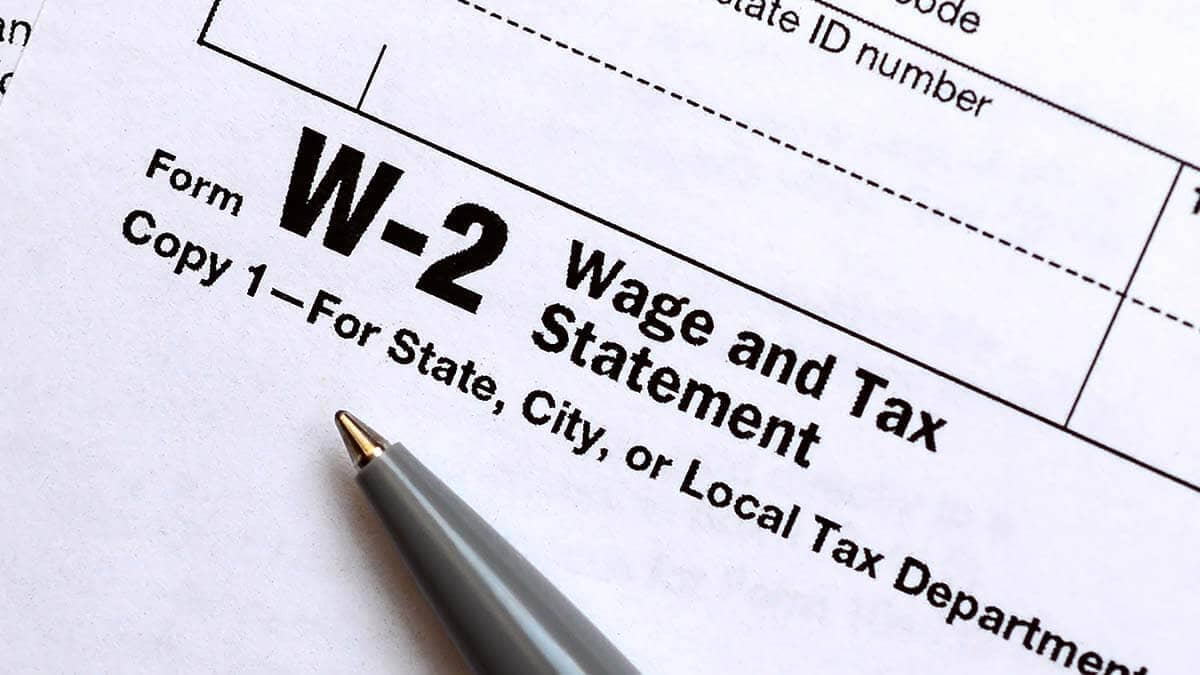

No More Guessing On Your Tax Refund. The Current Use Board is proposing to readopt with Amendment Cub 30503 Cub 30504 -Assessment Ranges for Forest Land Categories With and Without. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Enter your info to see your take home pay. For Taxable periods ending on or after December 31 2016 the BPT rate is reduced to 82.

As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on Monday April 18 2022. Take the purchase price of the property and multiply by 15. New Hampshire Income Tax Calculator How To Use This Calculator You can use our free New Hampshire income tax calculator to get a good estimate of what your tax liability will be come April.

Newer Post Older Post Home. Choose an estimated withholding amount that works for you. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20.

SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes. For taxable periods ending on or after December 31 2018 the BPT rate is reduced to 79. Use this calculator to work out your basic yearly tax for any year from 2011 to the current year.

To use our New Hampshire Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Your average tax rate is. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920.

New Hampshire Income Tax Calculator 2021 If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. This 2022 tax return and refund estimator provides you with detailed tax results. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Real Estate Transfer Tax. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. During the year adjust your W-4 and manage your paycheck based tax withholding.

The new hampshire state tax calculator nhs tax calculator uses the latest federal tax tables and state tax tables for 202223. Estimate Today With The TurboTax Free Calculator. Timber Gravel Tax.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. New Hampshire State Tax Brackets Because there is no income tax on wages there are no New Hampshire income tax brackets. Low Income Housing Tax Credit.

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return Tax Calculator Estimate Your Taxes And Refund For Free Virtual Remote Tax Preparation Services H R Block Share this post. By the end of 2022 get your personal refund anticipation date before you prepare and e-file. New Hampshire does not tax individuals earned income so you are not required to file an individual New Hampshire tax return.

Estimate your federal income tax withholding. Your average tax rate is 1198 and your marginal tax rate. 186 Average In this guide well deep dive into taxes in New Hampshire and what these taxes mean to your wallet.

Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return. Nh tax return calculator Wednesday July 27 2022 Edit. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

Use this tool to. Once you have a better understanding how your 2022 taxes will work out plan accordingly. New Hampshire Income Tax Calculator 2021.

Taxes Due Today Last Chance To File Your Tax Return Or Tax Extension On Time Cnet

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

The Irs Extends Aca Recipient Copy Deadline For The 2020 Tax Year Blog Acawise Aca Reporting Solution

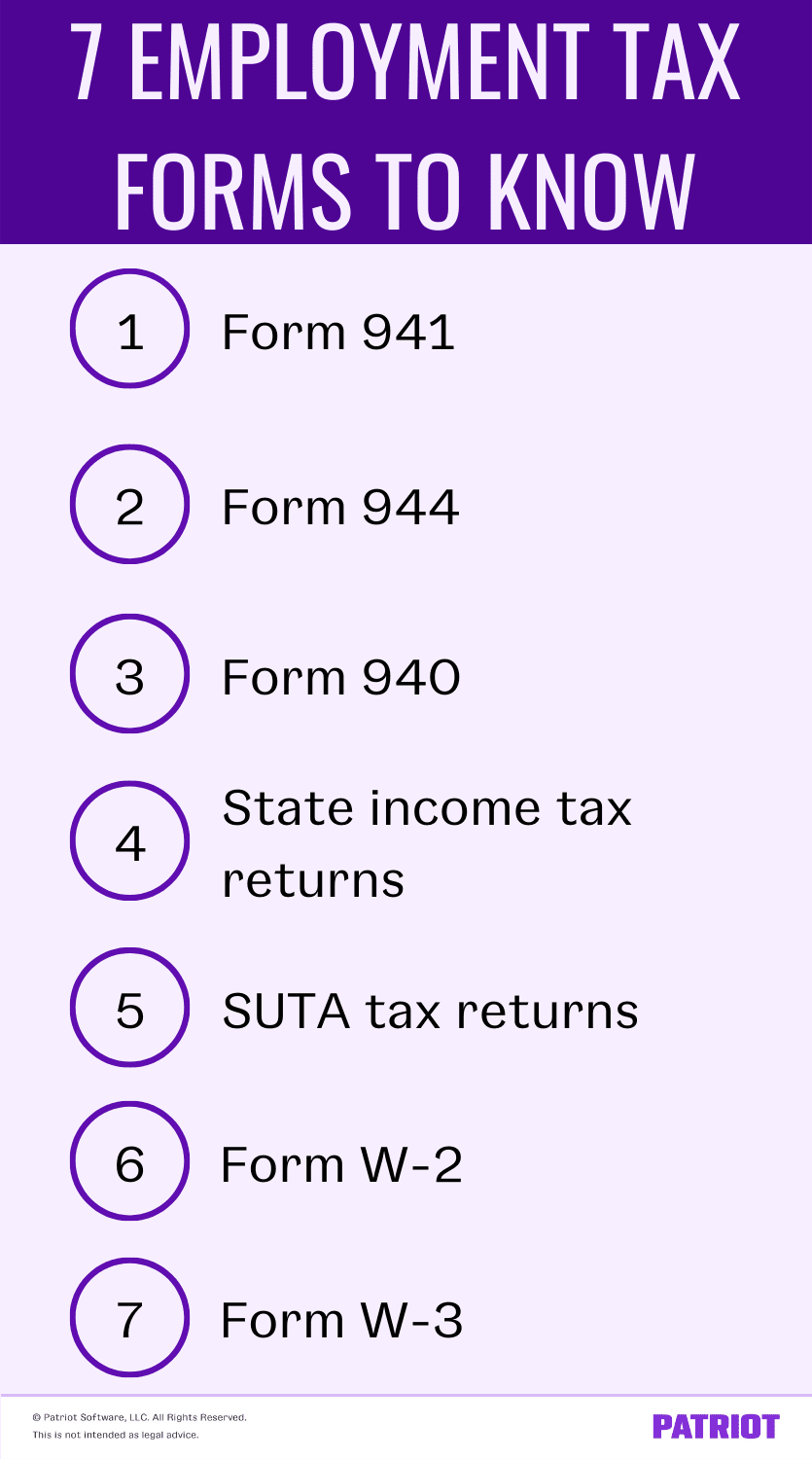

Employment Tax Returns Forms Due Dates More

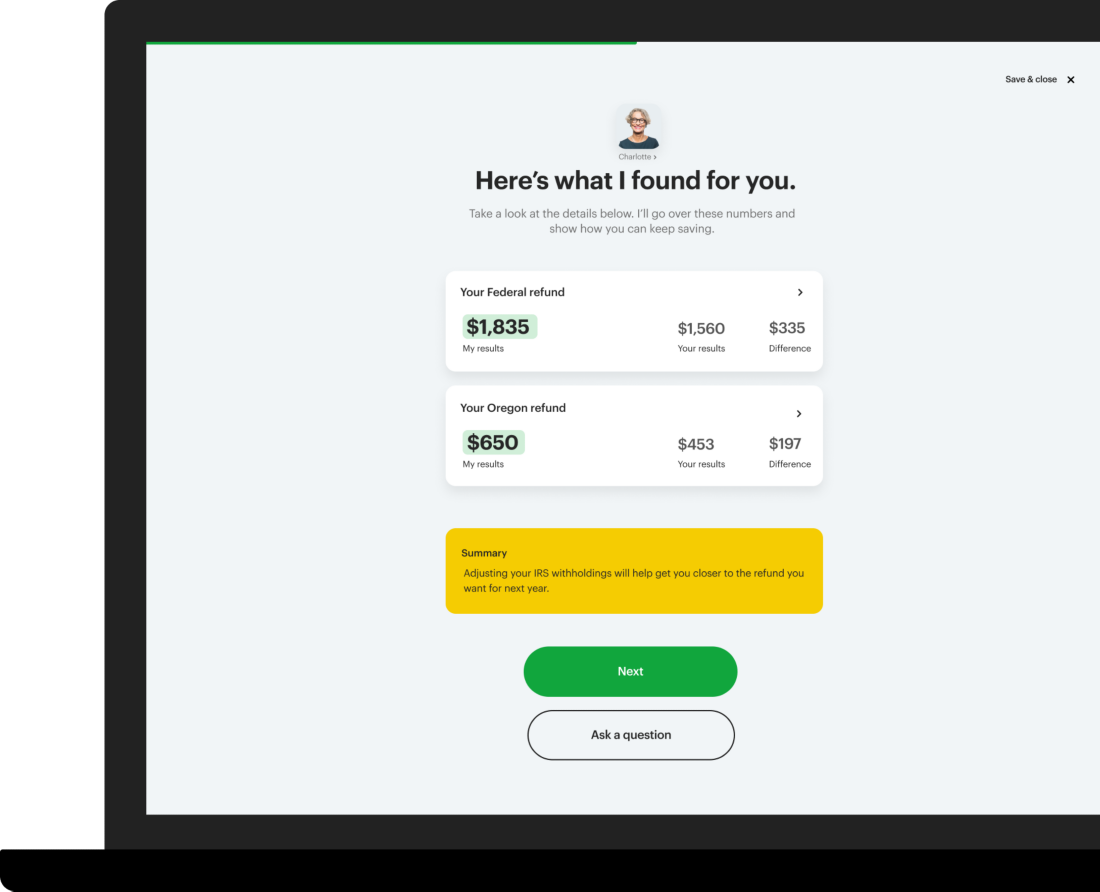

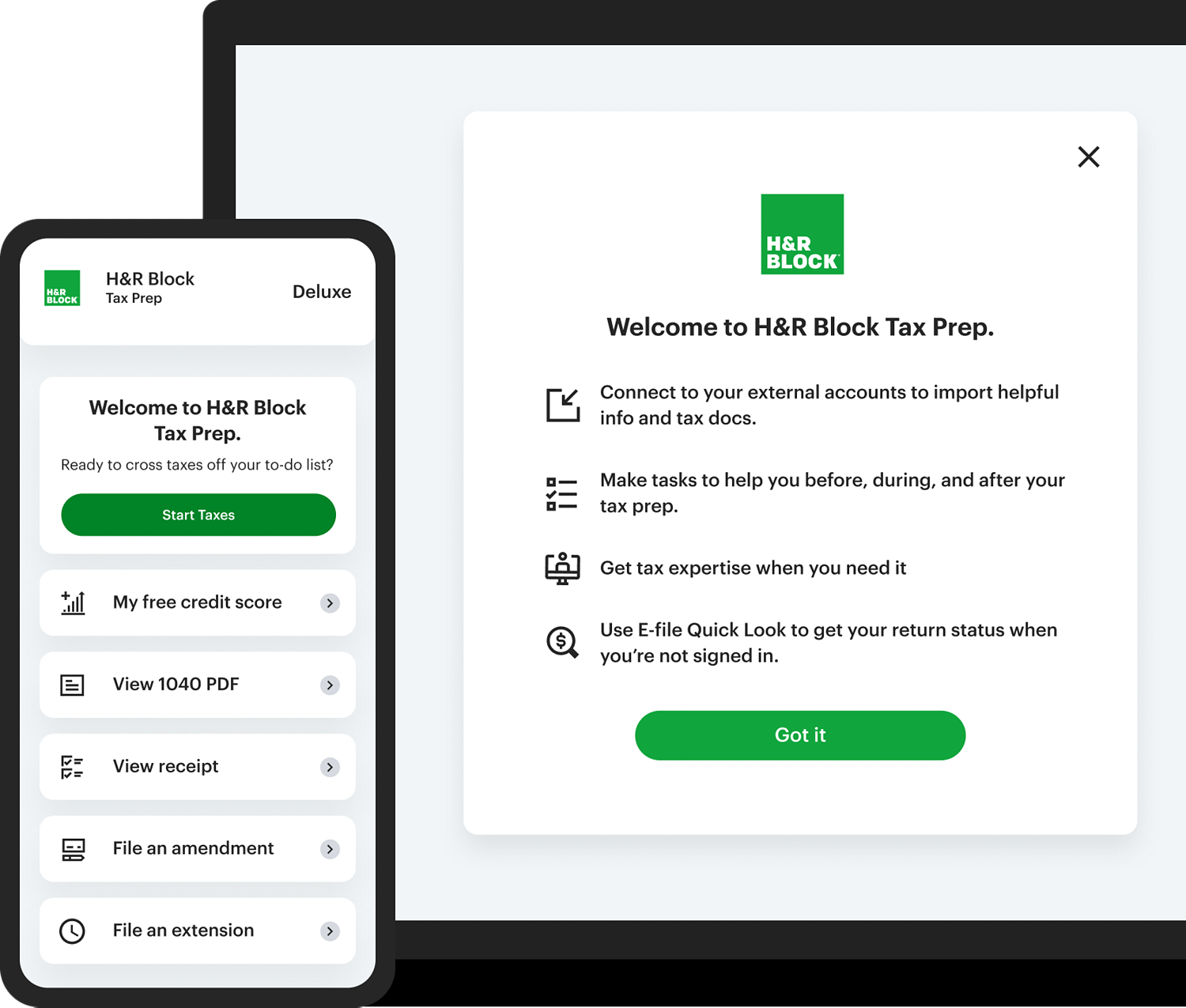

State Tax Filing Software H R Block

Employment Tax Returns Forms Due Dates More

Where S My Refund How To Track Your Tax Refund 2022 Money

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

3 12 16 Corporate Income Tax Returns Internal Revenue Service

Deluxe Online Tax Filing E File Tax Prep H R Block

Tax Changes What S New For Filing Taxes At The Irs In 2022 Money

Here S The Average Irs Tax Refund Amount By State Gobankingrates

3 11 13 Employment Tax Returns Internal Revenue Service

Tax Calculator Estimate Your Taxes And Refund For Free

Aca Reporting Requirements Employment Health Plan Human Services

Virtual Remote Tax Preparation Services H R Block

Ichra Affordability Calculator For Employers Health Insurance Coverage Ms Mississippi Employment