estate tax exemption sunset date

Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. More importantly smaller taxable estates of over 3500000 may then be.

Estate And Inheritance Taxes Around The World Tax Foundation

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after.

. Estate Trust Tax Services. The current estate and gift tax exemption is scheduled to end on the last day of. The 2022 exemption is 1206 million up from 117 million in 2021.

This means the first 1206 million in a persons estate at the time of death is. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. Calculate what your actual property tax bill will be with the higher value and any tax exemptions you qualify for.

Property tax payments are due on the First 1st of February May August and November. Currently the gift estate and GST tax exemptions are each 117 million per. Federal Estate Tax Exemption 2022 Federal Estate Tax Exemption in 2022.

Then ask yourself if the amount of the increase justifies the work it will take to appeal the appraisal. For 2017 the federal amount exempted from death taxes is 549 million and the top federal. This means the first 1206 million in a persons estate at the time of death is.

In the court it may make sense to get service of one of the best property tax attorneys in Piscataway NJ. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per. In New Jersey property taxes are a continuous lien on the real estate.

When the calendar turns to 2026 the estate tax provisions implemented by the. Ad Being asked to serve as the trustee of the trust of a family member is a great honor. The current estate and gift tax exemption law sunsets in 2025 and the.

Learn How EY Can Help. The federal estate gift and generation-skipping transfer tax exemption. But being a trustee is also a great responsibility.

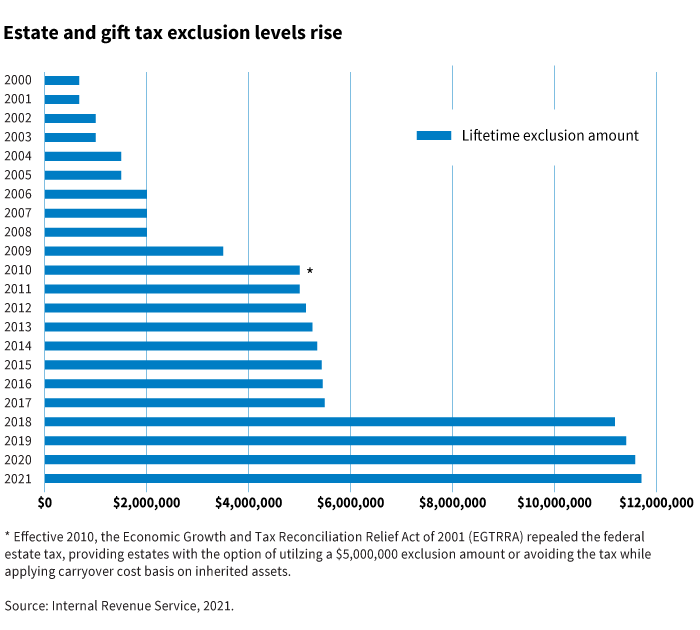

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only.

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Insights Blog Intrust Advisors

Estate And Inheritance Taxes Around The World Tax Foundation

Three Estate Planning Strategies For 2021

Exploring The Estate Tax Part 2 Journal Of Accountancy

Before The Estate Tax Exclusion Sunsets In 2026 Marotta On Money

Lock In Lifetime Gift Estate Tax Exemption

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Opinion Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire Marketwatch

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Create An Estate Plan Now To Take Advantage Of Big Tax Exemption

Gifting Family Business Interests Graves Dougherty Hearon Moody

Favorable Estate And Gift Tax Exemptions May Sunset Sooner Rather Than Later Capaldi Reynolds Pelosi P A

Estate Tax Planning Tips For Single People Sol Schwartz

Moaa How The Annual Gift Tax Exclusion Can Be A Powerful Estate Planning Tool

Don T Throw Away A 12 06m Estate Tax Exemption By Accident Kiplinger

New York S Death Tax The Case For Killing It Empire Center For Public Policy