pay estimated indiana state taxes

Have more time to file my taxes and I think I will owe the Department. Another deduction you can take on your federal return to try to nip away at your tax bill is for the income taxes you must pay to your state on your winnings.

After The Retail Apocalypse Prepare For The Property Tax Meltdown Meltdowns Tax Lawyer Property Tax

Indiana Income Taxes.

. All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay. There are special rules for farmers and fishermen certain household employers and certain higher income taxpayers. Find Indiana tax forms.

The State of Indiana has a flat penalty charged to anyone who fails to pay or file on time. Box 802502 Cincinnati. Indiana home sellers need to understand how these rate limits on capital gains taxes will affect their investment.

Each calendar year the state income tax due date may differ from the Regular Due Date because of a state. A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widower 469050 if you plan to file as head of. At the time I was unable to pay for a second state and open a Indiana return.

The credit for taxes paid to another state section will be at the end of your residence states interview process. Income tax rates to increase in these 3 central Indiana counties. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

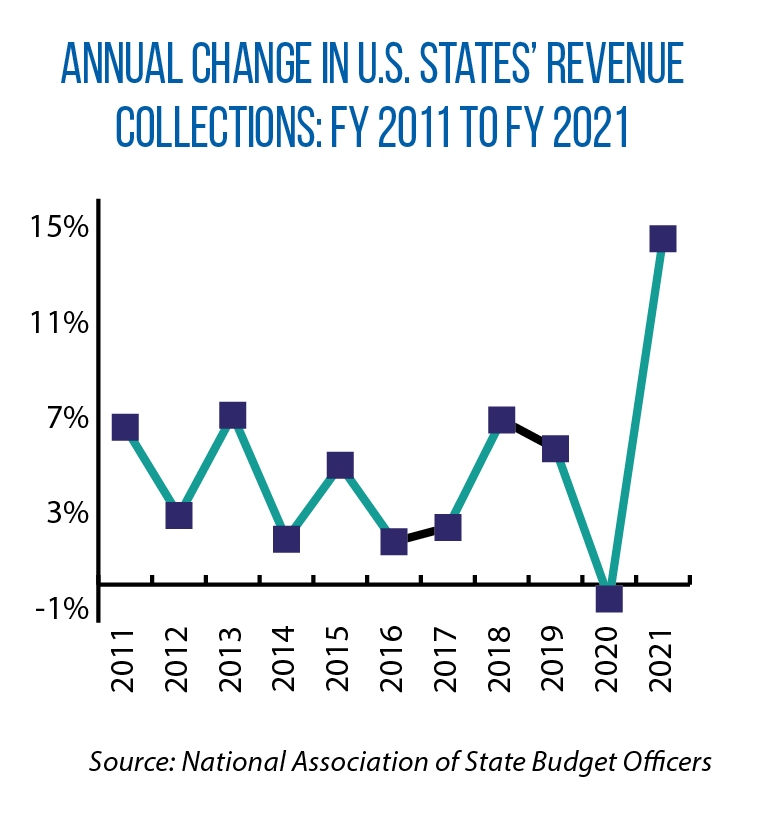

North Dakota States highway spending in 2018. Unlike the federal income tax system rates do not vary based on income level. Find out how to pay estimated tax.

That means no matter how much you make youre taxed at the same rate. Take the renters deduction. For those businesses with liability less than 10 per month you will file annually by the end of either January or July depending on your accounting method.

Please note that you will only get a tax credit for your IL state income taxes up to the amount of IN state income taxes that would have been paid if the income was earned in IN. W-2 income. Visit the Indiana Department of Workforce Development to learn more about filing for unemployment andor signing up to have Indiana State and county tax withheld.

Originally turbo tax calculated that I owed Ohio approximately 8000 because of my gambling winnings in Indiana. Put some money back to ensure you are able to pay your taxes. Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return.

Penalties and Interest for Late Payments. Cookies are required to use this site. A State program offered to senior blind or disabled citizens to defer their current year property taxes on their principal residence if they meet certain criteria.

Residents of Indiana are taxed at a flat state income rate of 323. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to. Your browser appears to have cookies disabled.

We have included the Regular Due Date alongside the 2022 Due Date for each state in the list as a point of reference. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. Individual Income Tax Return using the Wheres My Amended Return.

3358 Million Amount of states highway spending funded by motorist taxes. Pay my tax bill in installments. This way you wont need to pay all your tax at one time when you file.

Indiana counties local tax rates range from 050 to 290. Unlike your 1099 income be sure to input your gross wages. Indianas median income is 56350 per year so the median yearly property tax paid by Indiana residents amounts to.

Generally taxpayers should make estimated tax payments in four equal amounts to avoid a penalty. Meaning your pay before taxes and other payroll deductions are taken out. Claim a gambling loss on my Indiana return.

Rates do increase however based on geography. There will be a 10 fee of total tax due for those who do not pay according to the. 115 Billion State infrastructure tax revenues.

For more information refer to Form 1040-ES Estimated Tax for Individuals. After updating my software yesterday and going to amend my taxes now TurboTax says they dont think I need to file a Indiana return and. You can check the status of your Form 1040-X Amended US.

Your state will also have estimated tax payment rules that may differ from the federal rules. This box is optional but if you had W-2 earnings you can put them in here. Indiana Internal Revenue Service PO.

As long as I pay in a combo of estimated taxes and w2 withholding 100 of previous year tax liability or 110 if 150K AGI I should be safe. Eric Holcomb said an estimated 43 million taxpayers will receive a 125 refund after filing their 2021 state taxes. In the table below you will find the income tax return due dates by state for the 2021 tax year.

Indiana has one of the lowest median property tax rates in the United States with only ten states collecting a lower median property tax than Indiana. Know when I will receive my tax refund. Income Tax Deadlines And Due Dates.

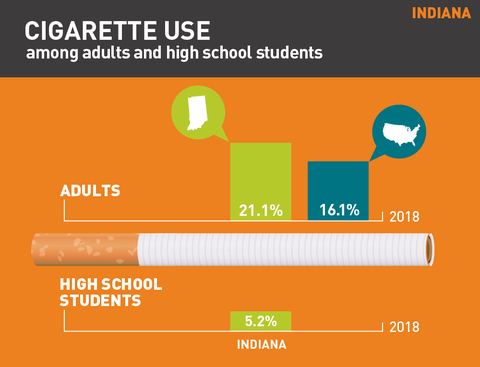

The median property tax in Indiana is 085 of a propertys assesed fair market value as property tax per year. Unfortunately the Tax Cuts and Jobs Act limits this itemized deduction to 10000 for tax years 2018 through 2025 and to just 5000 if youre married and filing a separate return. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

Public Auction An auction held pursuant to the California Revenue and Taxation Code Section 3691 in which the Department of Treasurer and Tax Collector auctions and sells tax. Im having an issue with my 2016 taxes.

Indiana State Tax Information Support

Dor Owe State Taxes Here Are Your Payment Options

Minnesota State Chart South Dakota State

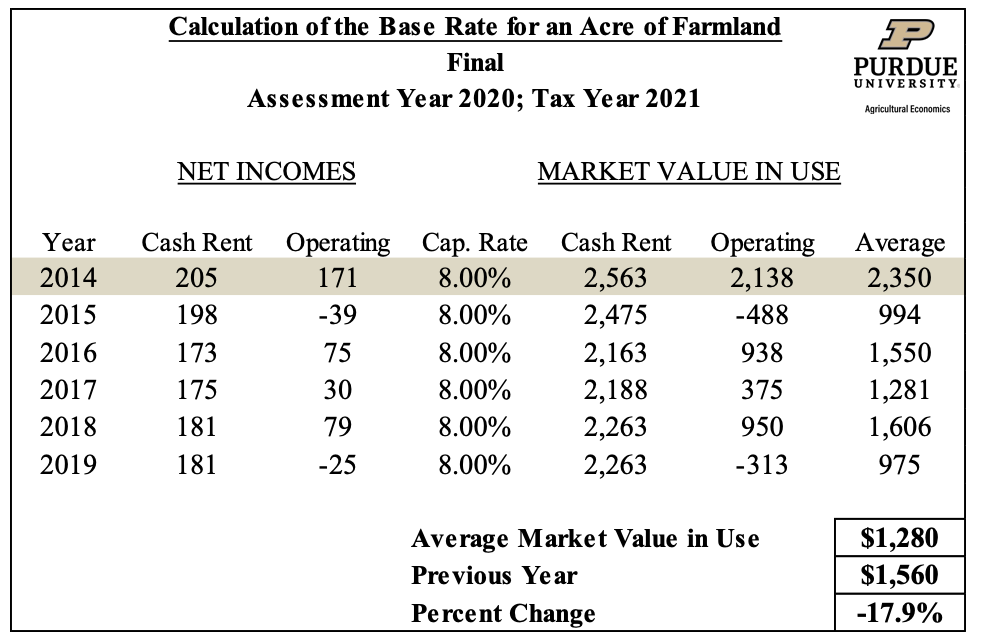

Farmland Assessments Tax Bills Purdue Agricultural Economics

Property Tax Rates Across The State

Dor Indiana Extends The Individual Filing And Payment Deadline

Indiana Sales Tax Small Business Guide Truic

Indiana Taxpayers Should See Direct Deposit Refund Checks Soon

High Budget Reserves Trigger Automatic Refund In 2022 For Indiana Taxpayers Csg Midwest

Property Tax Rates Across The State

Dor Owe State Taxes Here Are Your Payment Options

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Indiana Dept Of Revenue Inrevenue Twitter

Indiana County Income Taxes Accupay Tax And Payroll Services